Introduction

Managing bank data effectively is vital for any organization’s financial well-being. NetSuite Accounting provides tools for importing and matching bank data, which can greatly streamline the reconciliation process. However, these tools can be complex to understand and use. In this blog, we aim to simplify the process of matching bank data in NetSuite audit trail, highlighting key features and providing clear, step-by-step guidance. Whether you’re new to NetSuite or seeking to improve your reconciliation workflow, this guide is designed to help you maximize NetSuite’s bank data-matching capabilities.

Automated Matching

NetSuite Accounting‘s Intelligent Transaction Matching feature automatically matches imported bank lines with existing account transactions or creates and matches new transactions.

Manual Matching

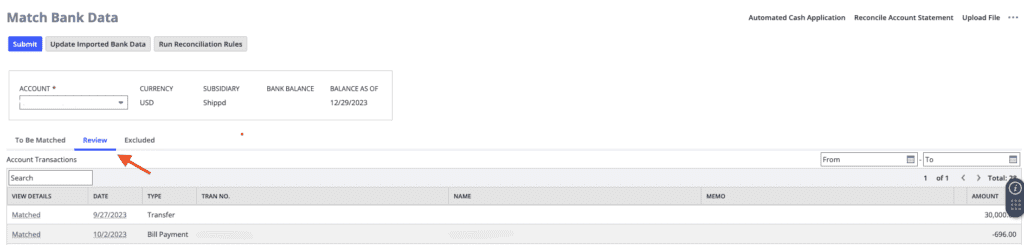

For unmatched transactions, filter the grids and manually select transactions to match. You can also mark transactions as cleared or pending submission.

Consideration: Keep in mind that editing, voiding without a reversing journal entry, or deleting transactions can affect their matched or cleared status.

Custom Transactions

To match and reconcile custom transactions, enable the “Show All Transaction Types In Reconciliation” option in Netsuite Accounting Preferences.

Steps to Match:

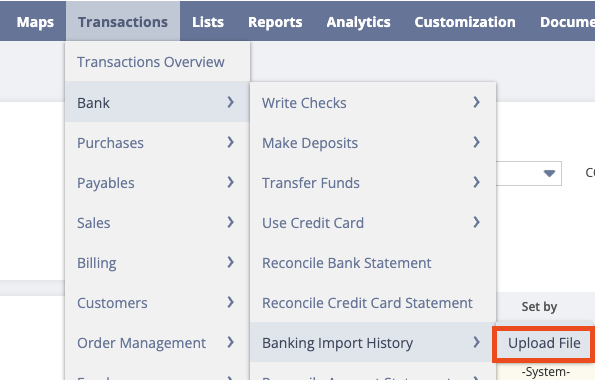

1. Import your bank data.

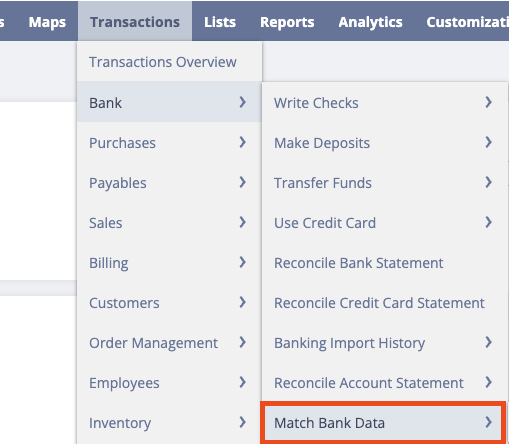

2. Go to Transactions > Bank > Match Bank Data.

3. Select the account for matching.

4. Review the populated fields for accuracy.

5.Identify and match in-transit payments. Use filters to manage the data. Match transaction items on the “To Be Matched” subtab.

Tip: Check processing completion before matching dimmed bank lines and match smaller groups of transactions to avoid performance issues.

Conclusion

By following these steps, you can simplify the process of matching bank data in NetSuite Accounting, making reconciliation more efficient and accurate. Whether utilizing the automated matching features or manually filtering and selecting transactions, the process can be simplified with a systematic approach. Remember to consider the impact of editing, voiding, or deleting transactions on their matched status, and leverage customization options for a tailored experience. With these tips in mind, you can navigate the complexities of bank data matching in NetSuite audit trail with ease, ensuring your financial records remain accurate and up to date.

About Us

We are a NetSuite Solutions provider with 30+ years of combined experience. We specialize in implementation, optimization, integration, rapid project recovery and rescue as well as custom development to meet any business need. Although every business is unique, with 40+ NetSuite clients over the last 5+ years our team has most likely seen your challenge or created a similar solution. If you would like more information on NetSuite approval workflow or just have questions on your project, feel free to contact us Here.