Introduction

Effectively managing fixed assets is essential for businesses to track, depreciate, and optimize the use of their valuable resources. NetSuite offers a method to simplify the process of setting up accounts for fixed assets and creating asset types. In this blog post, we’ll outline the steps to set up fixed asset accounts, asset types, and depreciation methods in NetSuite highlighting some key benefits of using the NetSuite Fixed Asset Management solution.

Setting Up Accounts for Fixed Assets

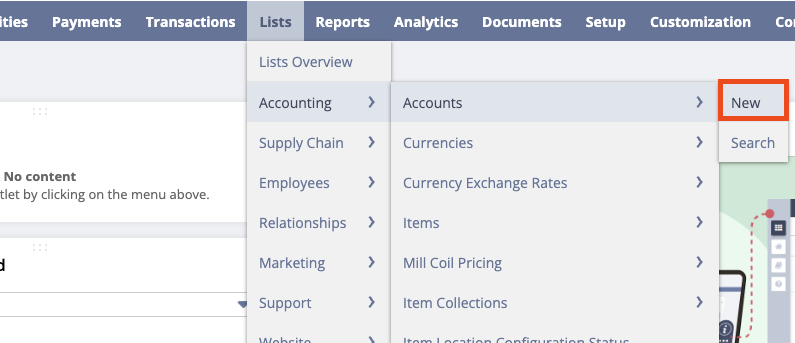

Navigate to Lists > Accounts click New or click the Edit link of the account that you want to set up.

In the Show in NetSuite Fixed Assets Management field, select the Fixed Assets Management account. To select multiple accounts, hold down the CTRL key and click on the accounts.

Click Save.

Create Asset Type

Go to Fixed Assets > Setup > Asset Types > New.

Enter the values for the following fields:

- Name

- Description

- Accounting Method (default depreciation method)

- Residual Percentage

- Asset Lifetime

Enter the values in the fields on the General Subtab:

- Depreciation Active (True)

- Revision Rules

- Depreciation Rules

Enter the values in the fields on the Accounting Subtab (if applicable):

- Asset Account

- Depreciation Account

- Depreciation Charge Account

- Write Off Account

- Write Down Account

- Disposal Cost Account

Click Save.

Create Depreciation Method

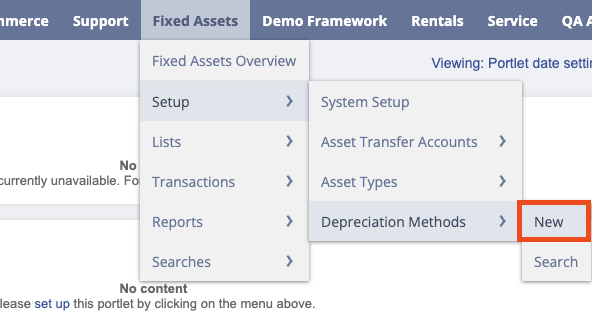

Navigate to Fixed Assets > Setup > Depreciation Methods > New.

On the New FAM Depreciation Method page, enter the following details:

- Name

- Depreciation Method Description

- Depreciation Period

- End Period Number

- Next Depreciation Period

- Depreciation Formula

Click Save.

Benefits of Fixed Asset Management in NetSuite

Accurate Financial Reporting:

Ensure accurate and compliant financial reporting with well-defined fixed asset accounts and types.

Efficient Tracking and Depreciation:

Streamline the tracking of fixed assets and automate depreciation calculations, reducing manual errors.

Enhanced Decision-Making:

Obtain real-time insights into the value and condition of fixed assets, enabling better decision-making.

Simplified Audits:

Facilitate smoother audits by maintaining a well-organized fixed asset structure within NetSuite.

Conclusion

By following the steps outlined above, you can establish a solid foundation for setting up fixed assets efficiently within the NetSuite ERP platform. Properly configured accounts and asset types not only ensure accurate financial records but also contribute to improved compliance. Utilize the features of NetSuite to optimize your fixed asset management processes and propel your business to new heights!

About Us

We are one of the leading NetSuite consultants with 30+ years of combined experience. We specialize in implementation, optimization, integration, rapid project recovery and rescue as well as custom development to meet any business need. Although every business is unique, with 40+ NetSuite clients over the last 5+ years our team has most likely seen your challenge or created a similar solution. If you have questions on your project or seek guidance on NetSuite customization per your needs, feel free to contact us Here.