Introduction

In Part 1 of this blog series, Simplifying Bank Data Matching in NetSuite, we covered the basics of matching bank data in NetSuite, including automated and manual transaction matching. Now, in Part 2, our focus will be on fine-tuning NetSuite for a more seamless and effective reconciliation workflow. We’ll explore advanced settings, customization options, and best practices to enhance your bank data-matching. Whether you’re looking to improve accuracy or reduce manual intervention, this guide will provide you with the necessary steps to optimize the process.

Enhancing Automated Matching

NetSuite’s Intelligent Transaction Matching is powerful, but you can refine it further by configuring matching rules and preferences.

Optimizing Manual Matching with Custom Filters

For unmatched transactions, NetSuite allows filtering and manual selection. You can refine this process by configuring custom views.

Steps to Set Up Custom Filters:

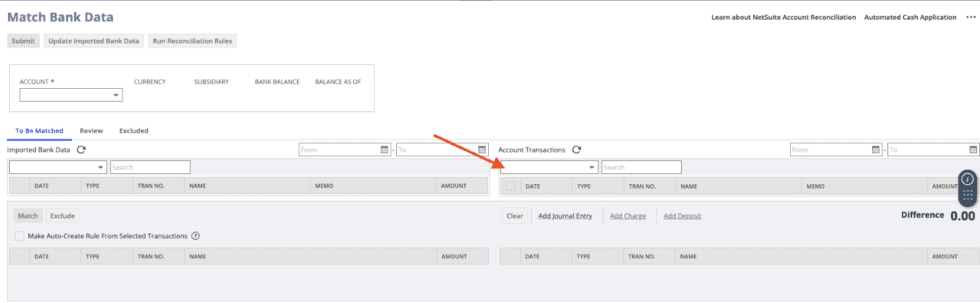

Navigate to Match Bank Data Page

Transactions > Bank > Match Bank Data.

Customize Filters

Use the filter panel to sort transactions by date, amount, or transaction type.

Navigate to “Reports > Saved Searches > New.

Select Transaction as the search type, then add filters based on your bank data fields like “Account”, “Check Number”, “Transaction Date”, “Amount”, and “Memo” to identify matching transactions, ensuring the filters align with the format of your bank data; save the search for future use.

Handling Complex Reconciliation Scenarios

For organizations dealing with multi-entity operations, intercompany transactions, or custom transactions, additional configurations may need to be applied.

Steps for Custom Transactions Matching:

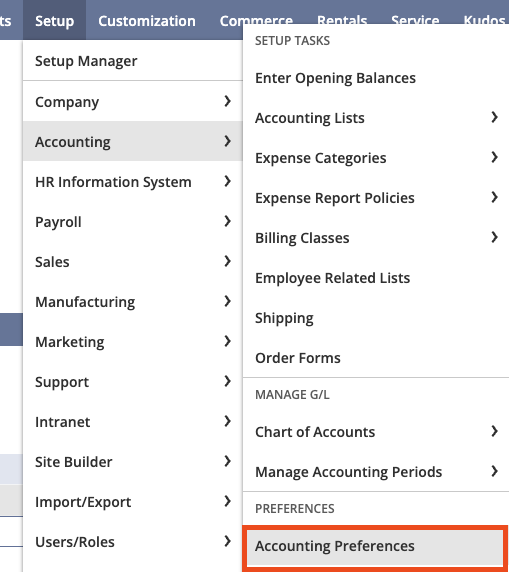

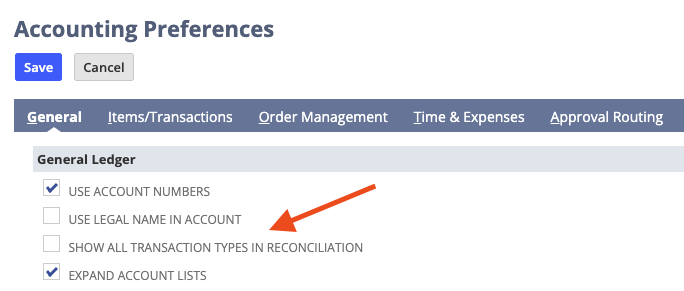

Enable All Transaction Types in Reconciliation

Setup > Accounting > Accounting Preferences.

Under the General Ledger tab, check “Show All Transaction Types in Reconciliation.”

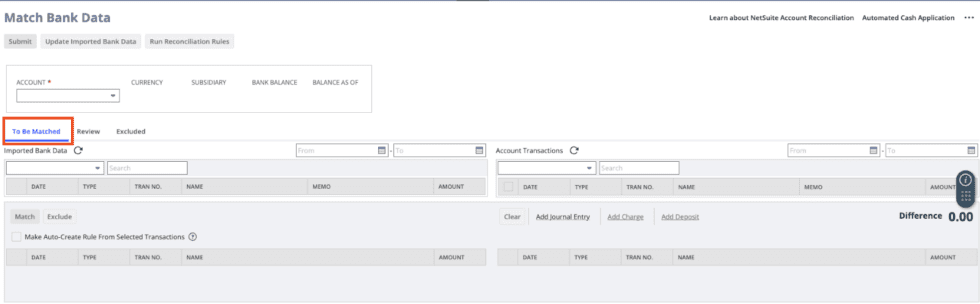

Reconcile Custom Transactions

When matching bank data, review the To Be Matched subtab to ensure all custom transactions appear.

Adjust Currency Preferences for Multi-Currency Transactions

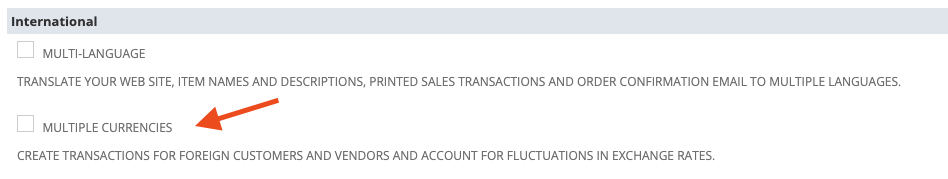

When dealing with foreign transactions, navigate to Setup > Company > Enable Features.

Enable Multi-Currency Bank Matching to allow NetSuite to match foreign currency transactions based on exchange rate rules. Check the Multiple Currencies box under the Company subtab

Save changes.

Preventing Common Reconciliation Errors

To avoid discrepancies and ensure accuracy, follow these best practices:

- Review Pending Transactions: Before reconciling, ensure all transactions are posted correctly.

- Avoid Editing Matched Transactions: Voiding or deleting transactions can break matches and create errors.

- Use Smaller Batches: Matching transactions in smaller groups prevents system slowdowns and ensures smoother processing.

Conclusion

Streamlining your financial processes in NetSuite starts with optimizing bank data matching. By configuring automated matching settings, refining manual filters, and utilizing advanced reconciliation options, you can achieve greater accuracy and efficiency. Follow these best practices to enhance your NetSuite workflow, and stay tuned for more advanced tips!

About Us

We areNetSuite Solutions Providerswith 30+ years of combined experience. We specialize in implementation, optimization, integration, rapid project recovery & rescues, and custom development to meet any business need. Although every business is unique, serving over 40 NetSuite clients during the last 6 years our NetSuite Consulting team has most likely seen your challenge and created a similar solution. For more information on NetSuite solutions or questions about your project contact usHere.