When purchase orders, item receipts, and vendor bills are entered into NetSuite tools for items you buy, each transaction will contain quantity, price, and exchange rate attributes for these items. If there are any discrepancies between these field values from the purchase order and receipt against the vendor bill, a variance value may post against the Accrued Purchases account. If you have enabled the Advanced Receiving feature in NetSuite, you can use the post vendor bill variances process to create journal entries to specific variance accounts that are based on these discrepancies.

Type of Variances:

There are three types of variances that NetSuite will check for between the Receipt and the Purchase Order.

- Price Variance

- Quantity Variance

- Exchange Rate Variance

Setting Up Item Records for Variances

To be able to calculate variances for items, the following need to be set up on the item records.

- Variance Accounts

- Default Setting for Match Bill to Receipt

Variance Accounts:

In NetSuite, you can set up GL COGS accounts that will be used to post calculated vendor bill variances when you process and generate variance journals. You can create individual accounts for Price, Quantity, and Exchange Rate or you can use a single account to post all variance types.

On an item record, you must select variance accounts in the Exchange Rate Variances, Bill Quantity Variances, and Bill Price Variances fields. Then, when a variance occurs for that item, it posts to the variance account you selected. If you prefer to see one single variance, select the same account in all three variance account fields.

Match Bill to Receipt

On an item record, check this box if you want the Match Bill to Receipt box to be checked by default on transaction lines for this item. Then, purchase orders that include this item default to have this box checked, and variances are generated based on vendor bill lines.

Clear this box if you do not want the Match Bill to Receipt box to be checked by default on transaction lines for this item. You can still check the box on individual transaction lines as necessary.

Price Variance Transactions Example:

Below is an example of a price variance that may occur between transactions. For any of the three types of variances identified in the system, the calculations are the same, however, NetSuite allows you to designate the variance account for posting each type of variance.

For the purchase order we add an item with the following attributes:

| Purchase Order | ||||

|---|---|---|---|---|

| Quantity | Price Per Unit | Amount | Exchange Rate | |

| Item 1 | 10 | $100.00 | $1,000.00 | 1 |

We create an item receipt and receive the items into the warehouse location with the following:

| Item Receipt | |

|---|---|

| Quantity | |

| Item 1 | 10 |

Once we receive the bill from the vendor, we enter the following into NetSuite:

| Vendor Bill | ||||

|---|---|---|---|---|

| Quantity | Price Per Unit | Amount | Exchange Rate | |

| Item 1 | 10 | $110.00 | $1,100.00 | 1 |

Notice that the Price Per Unit on the Vendor Bill is $10 more than the amount that was entered on the Purchase Order. This Price per unit difference will result in a variance when NetSuite compares the Total Amount of the Vendor Bill and the Purchase Order.

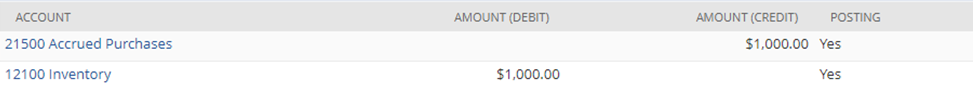

Transaction GL Impacts:

The GL Impact for the Item Receipt will credit Accrued Purchases and Debit Inventory for the $1000 which is the Quantity * Price Per Unit * Exchange Rate. In our example, this is (10 * 100 * 1) = 1000.

The GL Impact for the Vendor Bill will credit Accounts Payable and Debit Accrued Purchases for $1100, which is the Quantity * Price Per Unit * Exchange Rate. In our example, this is (10 * 110 * 1) = 1100.

Calculating the Variance:

NetSuite will calculate the variances using the following formulas:

Item Receipt Amount = Quantity * Price Per Unit * Exchange Rate

Vendor Bill Amount = Quantity * Price Per Unit * Exchange Rate

Price Variance = Vendor Bill Amount – Item Receipt Amount As we can see, the price variance between the Purchase Order/Item Receipt and the Vendor Bill is $10 per unit which results in a total price variance amount of $100. In order to reconcile this price variance, we will need to generate a variance journal entry in NetSuite.

Posting Vendor Bill Variances and Creating Variance Journals

- Navigate to Transactions > Payables > Post Vendor Bill Variances

- Verify or select the posting period for the journal entry you are creating

- Verify or enter the date for the journal entry. This defaults to the current date

- Select the subsidiary of the transaction, One World accounts only

- In theTransaction Typefield, make a selection to filter the list of transactions:

- ChoosePurchase Orderto show closed purchase order lines with a variance that do not have theMatch Bill To Receiptbox checked

- ChooseBillto show only vendor bills linked to Purchase Orders that have theMatch Bill To Receiptbox checked

- When you have selectedBillin theTransaction Typefield, you can make a selection in theTransaction Statusfield:

- ChooseOpento show all open vendor bills

- ChoosePaid in Fullto show only vendor bills that are completely paid

- In theVendorfield, select a vendor to filter the list to show only transactions associated with the selected vendor

- Clear theInclude Bills Without Receiptsbox to exclude bills from the list that have no item receipts entered against them. Check this box to include all bills regardless of receipts

- Check the box in theSelectcolumn next to all transactions you want to create a variance journal entry

- ClickCreate Journal Entries. The Post Vendor Bill Variances Results page opens and shows the journals created by the entry. You can click the link to open the journal and see the lines posted

If you are facing any issue in the above-mentioned procedure, connect with NetSuite experts, they will happy to assist you.

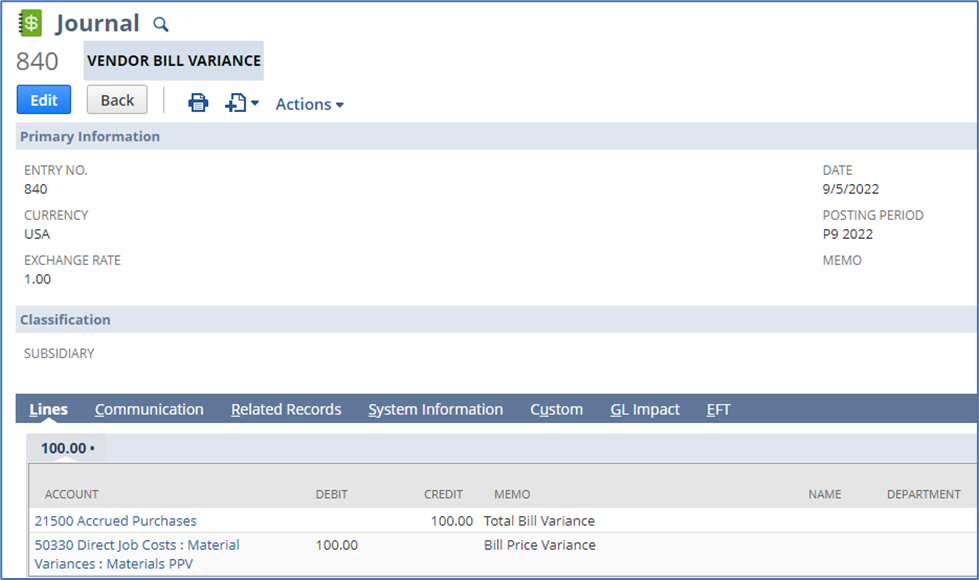

Once you click the Create Journal Entries button, a processing screen will open that shows the status of the variance journals that are being created in NetSuite with a status. Once complete, the Journal Entry document number will display and can be opened by clicking on the record.

In our price variance example from above, we calculated a variance between the receipt and vendor bill of $100 because the per unit price on the vendor bill was higher by $10 per unit and we had a quantity of 10 units purchased.

NetSuite calculated this $100 variance and applied it to the following variance journal entry.

The GL impact on the variance journal is a credit of $100 to the Accrued Purchases account and a debit of $100 to the variance account that is associated to capture price variances in our instance of NetSuite.

This allows us to offset the $100 in Accrued purchases and account for the variance in a separate account. The benefit of this is to keep the Accrued Purchases account from accruing these variances until the end of time.

In future posts, we will demonstrate how to create a sublist of the Variance Journal entries that allows you to see which Vendor Bills contributed to the generation of the journal. We will also demonstrate how to build a saved search that will allow you to balance the Accrued Purchases account and identify discrepancies where the documents related to the Purchase order are out of balance.

About Us

We are a NetSuite Solutions Partner and reseller with 30+ years of combined experience. We specialize in implementation, optimization, integration, rapid project recovery and rescue as well as custom development to meet any business need. If you would like more information on NetSuite or are in need of consultation for your project or implementation, feel free to contact our NetSuite support.

To Contact Us ClickHere