Introduction to 1099 Reporting

In our previous blog, Mastering Vendor Payment Reporting with NetSuite’s 1099 Saved Searches we introduced NetSuite’s 1099 Saved Searches feature, designed to streamline vendor payment reporting for tax purposes. This follow-up blog delves deeper into the importance of the 1099 form for IRS tax reporting, particularly for businesses making payments to independent contractors or vendors. Any company that pays $600 or more to a vendor who is not an employee must file a 1099 form. Accurate and timely reporting is crucial to avoid fines or potential IRS audits. NetSuite’s 1099 Saved Searches provide tools to help businesses maintain compliance, automate reporting processes, and minimize errors for greater efficiency.

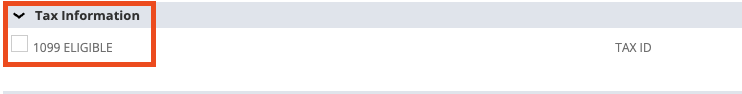

Setting Up Vendor Records for 1099 Eligibility

A critical step in ensuring your 1099 reports are accurate is configuring vendor records. To make a vendor 1099-eligible in NetSuite, follow the provided steps:

- Navigate to Lists > Relationships > Vendors.

- Edit the vendor record you want to update.

- On the vendor record, find the Financial subtab.

- Under the Tax Information section, ensure the 1099 Eligible box is checked.

- Click Save to apply the changes.

This step ensures that NetSuite will accurately classify, and track payments made to vendors who require 1099 reporting.

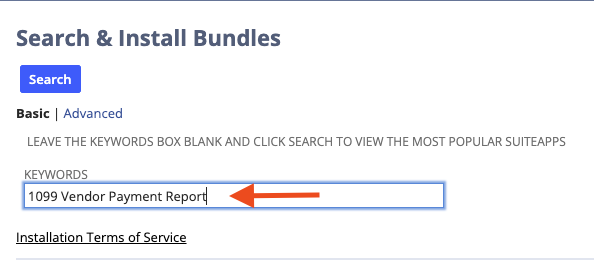

Creating and Customizing 1099 Saved Searches

After ensuring vendor records are properly configured, the next step is creating customized 1099 Saved Searches. This feature enables businesses to generate reports that capture detailed information about vendor payments, ensuring compliance with IRS regulations.

Steps to Create 1099 Saved Searches:

- Navigate to Customization > SuiteBundler > Search & Install Bundles.

- In the Keywords field, search for the 1099 Vendor Payment Report.

- Select the bundle and click Install.

- After installation, go to Reports > Saved Searches > 1099 Vendor Payment Report – Vendor Name and click Edit.

This will allow you to view and customize the pre-built 1099 Vendor Payment Report for your specific needs.

Customizing the Saved Search:

Once you’ve accessed the 1099 Vendor Payment Report, you may need to customize it to capture the specific information required for your business’s 1099 reporting:

- Use Case When formulas: These formulas allow you to set precise criteria for payments that should be included in your report, such as payment amounts, dates, and vendor status.

- Add or remove fields: Adjust the Results tab by adding or removing fields that reflect necessary information, such as vendor names, amounts paid, and dates of payments.

- Filtering out irrelevant data: Refine your search to ensure only the most relevant information is included, making the report cleaner and more useful.

- Preview and Export: After customizing your search, preview the results to ensure they are correct. Once verified, export the data to formats like CSV or Excel for submission or further analysis.

Best Practices for 1099 Saved Searches

To make the most of your 1099 Saved Searches in NetSuite, consider these best practices:

- Regular Updates: Ensure that vendor records are regularly updated to reflect accurate 1099 eligibility, especially if vendor circumstances change.

- Validate Payment Types: Double-check that payments are categorized correctly. Some vendors may receive multiple types of payments, so each must be properly identified for 1099 purposes.

- Test Saved Searches: Run Saved Searches periodically, not just at year-end, to identify any discrepancies or issues early on.

- Collaboration Across Teams: Work with finance and accounting teams to ensure that reporting criteria are aligned and that you meet compliance requirements.

Conclusion

NetSuite’s 1099 Saved Searches feature is an invaluable tool for businesses looking to streamline their vendor payment reporting. By properly setting up vendor records, creating customized Saved Searches, and adhering to best practices, companies can simplify their 1099 reporting, ensure compliance, and save time during tax season. With NetSuite’s robust customization features, businesses can efficiently manage the complexities of tax reporting, minimizing errors and reducing manual effort.

This approach ultimately leads to a smoother tax reporting process and better preparedness for IRS audits, ensuring that businesses can confidently navigate their financial operations while remaining compliant with tax laws.

About Us

We areNetSuite Solutions Providerswith 30+ years of combined experience. We specialize in implementation, optimization, integration, rapid project recovery & rescues, and custom development to meet any business need. Although every business is unique, serving over 40 NetSuite clients during the last 6 years our NetSuite Consulting team has most likely seen your challenge and created a similar solution. For more information on NetSuite solutions or questions about your project contact usHere.