What Is a Reverse Journal in NetSuite:

A reverse journal in NetSuite is a financial transaction used to negate the impact of a previously recorded journal entry. This functionality simplifies accounting adjustments by automatically creating a reversing entry, ensuring accurate financial statements without requiring manual corrections. Reverse journals are instrumental in accrual accounting, where transactions recorded in one period must be offset in the future.

Configuring NetSuite to Use Reverse Journals:

Enabling and configuring NetSuite to utilize reverse journals requires specific system settings. The following steps outline the necessary configurations:

- Define Reversal Preferences: Within Accounting Preferences under Setup > Accounting > Preferences > Accounting Preferences, configure default reversal settings, such as specifying whether reversals utilize approval routing (For more information on approval routing for journal entries visit part 1 or part 2 of our series) and how to handle voided transactions in a closed period.

- Options for Consideration: Approval Routing for Journal Entries and setting reversal dates in a closed period can impact your team’s financial workflow.

- User Role Permissions: Ensure that appropriate roles have the necessary permissions to create and manage reversing journal entries by adjusting role-based access under Setup > Users/Roles > Manage Roles.

Why Reverse Journals Are Important:

Reversing journals play a crucial role in maintaining financial accuracy and compliance. These system-created journals are often used to:

- Error Correction: Automatically offset incorrect or unnecessary journal entries, preventing manual intervention.

- Accrual Adjustments: Facilitates proper financial reporting by reversing accrual-based transactions in the next period.

- Audit Trail Integrity: Maintains transparency by systematically reversing journal entries rather than deleting or altering them.

How to Create a Reverse Journal in NetSuite:

Creating a reverse journal entry in NetSuite is a straightforward process:

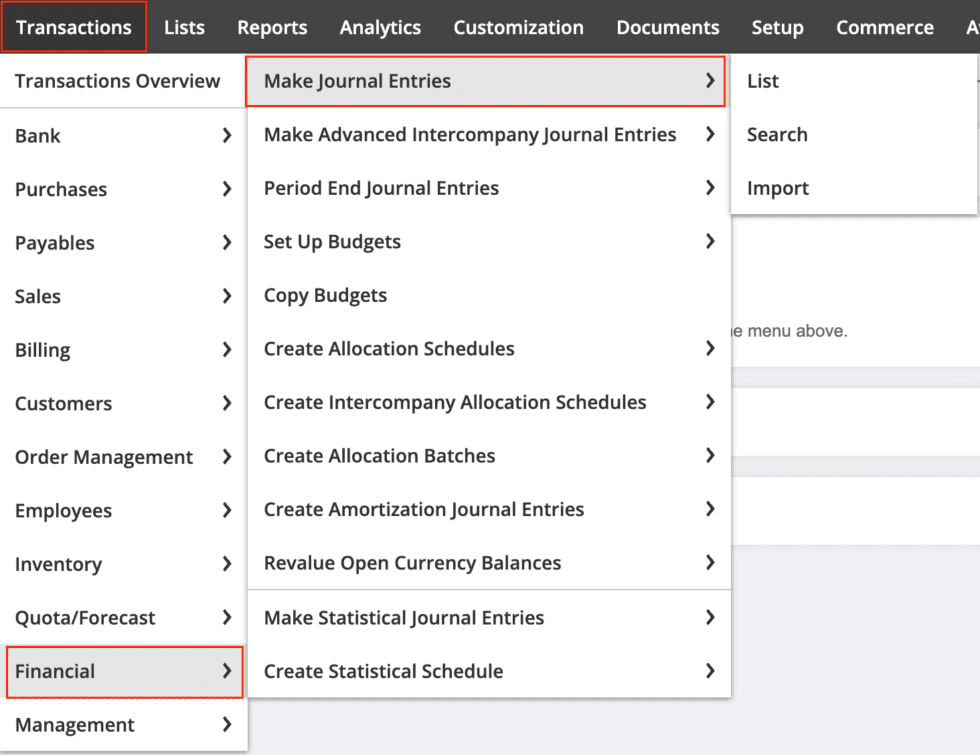

- Locate the Original Journal Entry: Navigate to Transactions > Financial > Make Journal Entries > List and find the entry requiring reversal.

- Initiate the Reversal: Open the journal entry, then provide a value for the Reversal Date, there is no specified menu option to create a reverse journal entry NetSuite automatically generates a reversal based on the field values for the Reversal Date and Defer entry.

- Set the Reversal Date: Specify the date for the reversing entry, which can be the next period or a custom date based on accounting preferences.

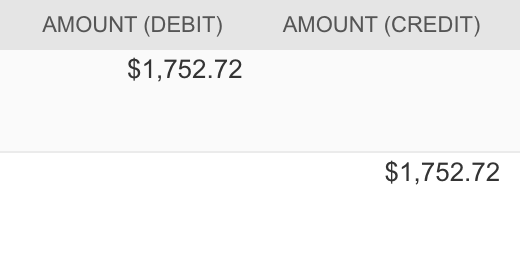

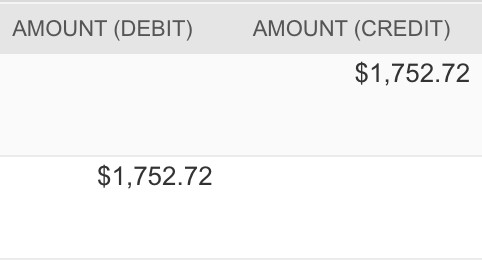

- Save and Post the Entry: Click Save, and NetSuite will automatically generate the reverse journal entry, mirroring the original transaction with opposite debit and credit values.

How to Delete a Reverse Journal in NetSuite:

Deleting a reverse journal in NetSuite requires modifying the original journal entry rather than removing the reverse entry directly:

- Modifying the Original Entry: To delete a reverse journal, navigate to the original journal entry and remove the “Reversal Date” field.

- Automatic Deletion: Once the reversal date is removed from the original entry, NetSuite will automatically delete the linked reversing journal entry.

- No Direct Deletion: A reversing journal entry cannot be directly edited or deleted on its own. Changes must be made through the original journal entry.

Conclusion:

Proper utilization of reverse journals enhances financial accuracy, streamlines adjustments, and supports best practices in accrual-based accounting. Configuring NetSuite correctly ensures seamless integration of this functionality into financial workflows, reducing manual errors, and improving reporting reliability.

About Us

We areNetSuite Solutions Providerswith 30+ years of combined experience. We specialize in implementation, optimization, integration, rapid project recovery & rescues, and custom development to meet any business need. Although every business is unique, serving over 40 NetSuite clients during the last 6 years our NetSuite Consulting team has most likely seen your challenge and created a similar solution. For more information on NetSuite solutions or questions about your project contact usHere.