Introduction

Managing multiple subsidiaries simultaneously can be complex and demanding for any size accounting department. For companies with a global presence, currency fluctuations alone can significantly impact profit margins, making monitoring each subsidiary’s performance difficult. Furthermore, navigating regulatory differences across varying jurisdictions can add stress, even for experienced accountants.

Fortunately, NetSuite offers powerful features and extensions that streamline these accounting processes, making operations efficient and accurate. This guide explores how multi-subsidiary companies can leverage NetSuite’s extensive features to simplify their financial operations.

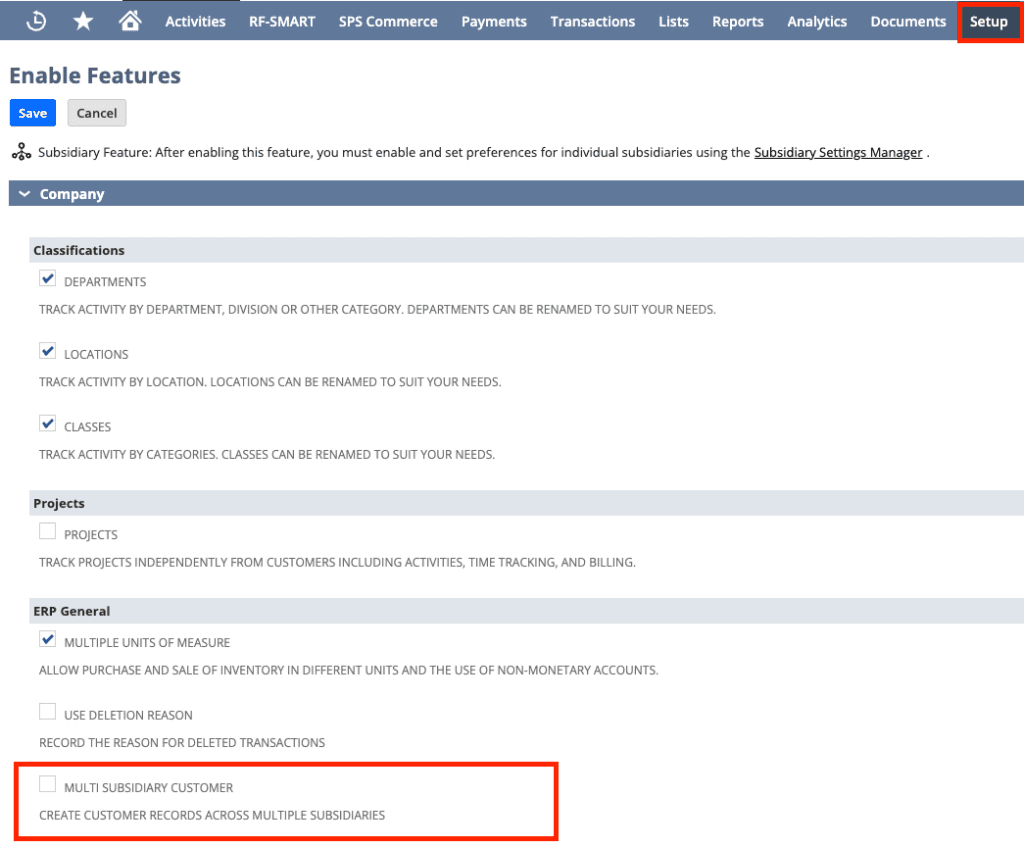

To enable multi-subsidiary accounting in NetSuite:

- Navigate to Setup > Company > Enable Features.

- In the ERP General section under the Company subtab, check Multi-Subsidiary Customer and click Save.

Review the Incompatible Features in the Multi-Subsidiary Customer Feature Limitations by clicking Learn More or hovering over the info icon near the checkbox. Once enabled, you can consolidate data from multiple subsidiaries in reports.

Effortlessly Centralize Multi-Subsidiary Financial Data

NetSuite simplifies centralizing financial information from multiple subsidiaries by ensuring that all business units follow uniform reporting standards. By consolidating data within a single system, companies can access real-time financial information, reducing manual inputs, minimizing errors, and eliminating labor-intensive global transaction record-keeping.

For example, imagine a U.S.-based company with subsidiaries in Mexico, Germany, and Japan. These subsidiaries operate under different local regulations, currencies, and accounting standards. Without automation, gathering and consolidating diverse financial transactions would be tedious. However, NetSuite’s multi-book accounting and consolidation features automatically gather, convert, and synchronize financial data, ensuring compliance with local standards while presenting accurate consolidated reports that reflect the company’s global, consolidated financial reporting.

Automatically Simplify Currency Conversions Across Subsidiaries

Currency conversion is critical for companies operating across multiple regions with different currencies. NetSuite’s automated currency management feature addresses this need efficiently by converting amounts based on the latest exchange rates. This automation eliminates the need for manual calculations, reducing the risk of conversion errors.

Consider the same U.S.-based company, with subsidiaries in Japan, Germany, and Mexico, transacting in Japanese Yen, Euros, and Mexican Pesos. NetSuite updates exchange rates daily automatically applying the appropriate exchange rate conversions. These features ensure that all financial transactions and reports reflect accurate, up-to-date financial values in the base currency for each subsidiary. This automation not only saves time but also ensures financial accuracy—an essential capability for businesses with international operations.

Streamline Intercompany Transactions for Consistency and Compliance

Multi-subsidiary companies often face challenges when managing intercompany transactions, including transfers of goods, services, or funds between subsidiaries. These transactions require profit elimination, accurate tracking, and timely reconciliation to prevent discrepancies. NetSuite automates the management of intercompany transactions, ensuring smooth operations and compliance with global regulations.

For instance, if the U.S. headquarters ships products to its subsidiary in Mexico, NetSuite’s intercompany transaction management can automate the entire process. The software applies the appropriate taxes, ensures compliance with local laws, and records accurate transactions consistently across both entities. NetSuite also uses elimination journal entries to remove duplicate transactions during consolidation, ensuring accurate financial statements.

Automate Tax Compliance and Reporting for Global Standards

Navigating tax requirements across multiple countries is one of the most complex challenges for multi-subsidiary companies. Each country has unique tax regulations, filing schedules, and reporting standards, making manual tax management overwhelming. With NetSuite’s automated tax management, businesses can handle these processes seamlessly.

In our example, the same U.S.-based company with subsidiaries in Germany, Mexico, and Japan must comply with varying VAT, GST, and income tax laws. NetSuite’s automated tax engine generates tax reports for each subsidiary according to the respective laws, ensuring compliance and timely submission. Additionally, it prepares consolidated tax reports in real-time, offering a global view of tax obligations.

Enhance Financial Reporting with Automated Multi-Subsidiary Consolidation

Preparing consolidated financial statements for multi-subsidiary companies can be daunting, particularly when each subsidiary operates under different currencies, accounting standards, and regulations. NetSuite’s multi-subsidiary consolidation feature automates these processes, allowing businesses to generate accurate consolidated financial reports at the click of a button.

For instance, the U.S.-based company mentioned earlier with subsidiaries across Asia, Europe, and North America needs to produce quarterly financial reports. NetSuite automatically adjusts for currency differences, tax implications, and intercompany eliminations, providing clear and accurate global accounting records. This capability enables executive teams to access real-time financial insights, facilitating timely decision-making without the delays associated with manual consolidation.

Conclusion

NetSuite’s robust capabilities simplify accounting and financial processes for multi-subsidiary organizations and also serves as a foundation for operational efficiency and strategic growth. The system maintains consistency in how subsidiaries are managed your organization can ensure clarity across reporting, automation, and financial consolidation. Tools like automated currency conversions, tax compliance, and intercompany transaction management enable you to focus on scaling across global markets instead of updating currency rates. These features highlight how a well-configured NetSuite system supports streamlined operations and accounting success. Click the link below to learn more about Optimizing NetSuite OneWorld: Efficient Item Setup for Multi-Subsidiary Organizations.

About Us

We are NetSuite Solutions Providers with over 30 years of combined experience. Our team specializes in implementation, optimization, integration, rapid project recovery, and custom development to meet any business need. With more than 40 NetSuite clients over the past five years, we have likely encountered challenges similar to yours and developed effective solutions. If you would like more information about NetSuite or have questions about your project, feel free to contact us here.