Introduction: What is a Subsidiary?

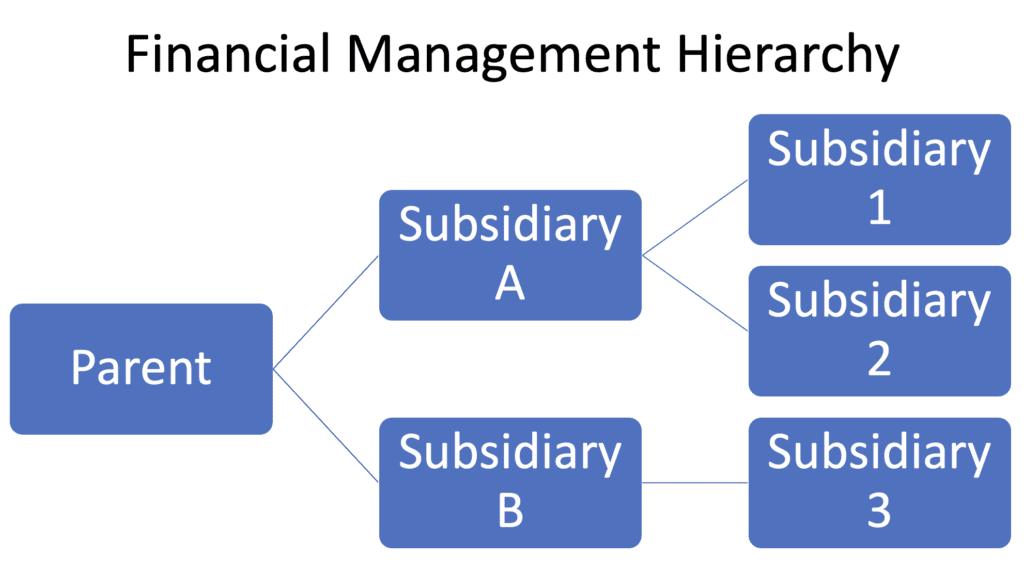

In the business world, a subsidiary is a company that belongs to another company, which is usually referred to as the parent company. The parent holds a controlling interest in the subsidiary company (child), meaning it has or controls some of its stock. In cases where a subsidiary is 100% owned by another firm, the subsidiary is referred to as a wholly owned subsidiary. Subsidiaries become very important when setting up a NetSuite financial management system. NetSuite CRM enables you to manage data for a hierarchical structure of separate legal entities, or subsidiaries, within your global organization. Each subsidiary can then be categorized with the use of classifications to organize data for reporting purposes.

Process Overview: How does a Subsidiary Work?

A parent company buys or establishes a subsidiary to provide the parent with specific synergies, such as increased tax benefits, diversified risk, or assets in the form of earnings, equipment, or property. Still, subsidiaries are separate and distinct legal entities from their parent companies, which reflects in the independence of their liabilities, taxation, and governance. If a parent company owns a subsidiary in a foreign land, the subsidiary must follow the laws of the country where it is incorporated and operates.

A subsidiary usually prepares independent financial statements. Typically, these are sent to the parent, which will aggregate them—as it does financials from all its operations—and carry them on its consolidated financial statements. In contrast, an associate company’s financials are not combined with the parents. Instead, the parent registers the value of its stake in the associate as an asset on its balance sheet.

Subsidiaries can contain and limit problems for a parent company. Potential losses to the parent company can be limited by using the subsidiary as a liability shield against financial losses or lawsuits. The subsidiary structure can also offer tax advantages: They may only be subject to taxes in their state or country, versus having to pay for all the parent’s profits.

Organization in NetSuite for Subsidiaries:

- Create a subsidiary

- Define the types of subsidiaries

- Create departments, locations and classes

- Create parent and child accounts

- Create accounts for banking

- Restrict accounts

If you are still facing issues and need guidance, then connect with NetSuite experts today!

Conclusion

Other accounting systems require separate general ledger accounts for each area of the organization, creating a large, confusing general ledger and cluttered financial statements. NetSuite uses classifications to facilitate your requirements for segmenting financial reporting resulting in a simplified general ledger, flexibility in financial reports, and fewer posting errors.

Audience

Administrator, Chief Financial Officer (CFO), Finance Team, Accounts Payable

Keywords

Elimination Subsidiary, Financials, Finance Fundamentals, Financial Management

About Us

We are a NetSuite Solutions Partner and reseller with 30+ years of combined experience. We specialize in implementation, optimization, integration, rapid project recovery and rescue as well as custom development to meet any business need. If you would like more information on NetSuite or in need of consultation for your project or implementation, feel free to contact our NetSuite support.

To Contact Us ClickHere