As organizations scale and operate across multiple legal entities, managing fixed assets becomes increasingly complex. Equipment, machinery, and long-term assets are often reallocated across departments, locations, or even subsidiaries. These movements must be reflected accurately in financial records to ensure compliance, clear reporting, and continued depreciation tracking.

NetSuite’s Fixed Assets Transfer functionality offers an efficient, audit-ready method to reassign assets within the organization. Whether you’re updating an asset’s operational classification or shifting ownership across subsidiaries, this feature ensures clean transitions and preserves your financial data integrity.

🚧 Common Scenarios That Require Asset Transfer

There are many reasons an organization may need to reassign an asset:

- A facility or warehouse closure results in asset movement to another business unit.

- Internal restructuring requires shifting ownership of assets to a new subsidiary.

- A change in how or where an asset is used demands updated classifications.

- Financial reporting requirements necessitate more accurate asset alignment across departments or legal entities.

🔁 How NetSuite’s Asset Transfer Functionality Helps

NetSuite’s asset transfer feature is designed to handle these scenarios with precision and transparency. With this tool, organizations can update:

- Subsidiary: Assign the asset to a new legal entity within your organization

- Department: Reclassifies the asset based on who is operationally responsible

- Class: Updates segmentation for financial or business unit tracking

- Location: Reflects the physical or logical location of the asset

These changes are managed in a single controlled process, helping to streamline asset lifecycle management across your business.

🧭 Walkthrough: Asset Transfer Form in NetSuite

To transfer an asset in NetSuite:

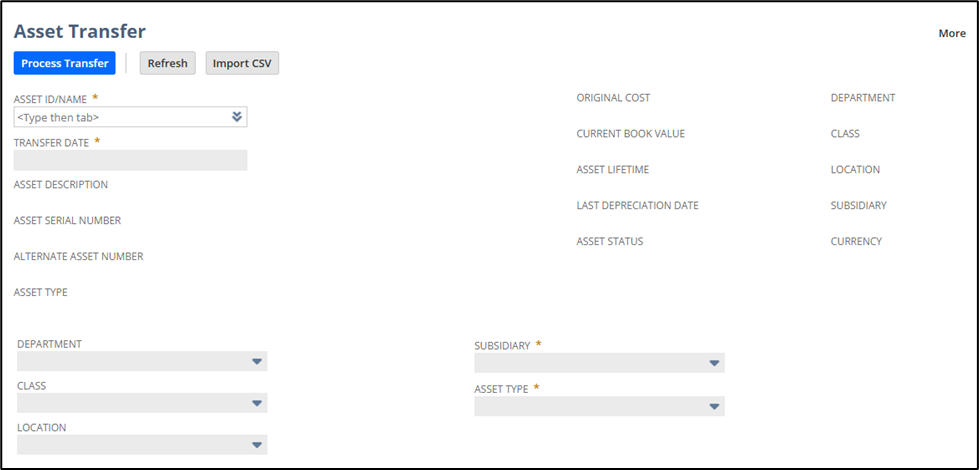

Navigate to: Fixed Assets → Transactions → Transfer Asset

🧾 Asset Transfer Form Fields Explained:

Here’s a breakdown of the key fields you’ll see on the Asset Transfer form, and what each one means:

| Field | Description |

| Asset | Select the fixed asset you want to transfer. Only assets that are not fully depreciated and are still active will appear. |

| Transfer Date | Choose the effective date for the transfer. This affects the depreciation schedule and accounting period. |

| New Subsidiary | Required for intercompany transfers. Choose the new legal entity that will now own the asset. |

| New Asset Type | If changing the asset type, select the new type. |

| New Department / Class / Location | Optional fields to reflect operational reclassification within the new context. Useful for reporting alignment. |

| Memo | Add notes explaining the reason for the transfer. These are helpful for audit tracking or management review. |

Click the Process Transfer button to trigger accounting and asset-level updates.

📘 What Happens When You Process a Transfer

Once you click Process Transfer, NetSuite performs several backend actions:

- The asset’s classification and subsidiary are updated.

- The remaining depreciation schedule is cleared.

- A set of intercompany journal entries is automatically created to reflect the financial movement of the asset.

📑 Journal Entries Created by NetSuite

When transferring an asset between subsidiaries, NetSuite automatically generates two journal entries; one in each subsidiary using the accounts defined in your Asset Transfer Accounts configuration.

📄 Example Entry for Source Subsidiary (Transfer Out):

| Account | Debit / Credit |

| Intercompany Clearing Account | Debit |

| Asset Account (e.g., Equipment) | Credit |

| Accumulated Depreciation | Debit |

| Gain or Loss on Transfer | Credit (if gain) or Debit (if loss) |

📄 Example Entry for Target Subsidiary (Transfer In):

| Account | Debit / Credit |

| Asset Account (same value) | Debit |

| Intercompany Clearing Account | Credit |

These entries ensure that both subsidiaries accurately recognize the correct asset valuation and prevent double-counting of depreciation.

🔧 Regenerating Depreciation After Transfer

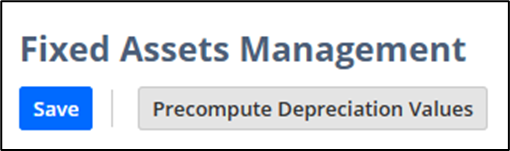

Once the asset has been transferred, it’s crucial to recompute the depreciation schedule:

- Go to Fixed Assets → Setup → System Setup

- Click the Precompute Depreciation Values button.

This generates a new schedule based on the remaining value, updated classifications, and the new subsidiary’s context.

🌟 Key Benefits of NetSuite Asset Transfer

- Improved Accuracy: Ensures that asset classifications and financial ownership are always up to date.

- Automated Intercompany Accounting: No need to manually book asset transfers or depreciation resets.

- Audit-Ready Recordkeeping: Maintains consistent asset IDs and financial traceability.

- Reliable Reporting: Keeps assets aligned with their current operational and legal context.

- Controlled Depreciation Tracking: Automates recalculation and prevents misstatements in books.

🧾 Conclusion

NetSuite’s Fixed Assets Transfer feature simplifies one of the most complex areas of asset management: intercompany and intra-organizational reclassification. With built-in financial automation, smart record handling, and audit-compliant depreciation recalculation, your business can stay nimble while keeping financial reporting rock-solid.

About Us

We areNetSuite Solutions Providerswith 30+ years of combined experience. We specialize in implementation, optimization, integration, rapid project recovery & rescues, and custom development to meet any business need. Although every business is unique, serving over 40 NetSuite clients during the last 6 years our NetSuite Consulting team has most likely seen your challenge and created a similar solution. For more information on NetSuite solutions or questions about your project contact usHere.